全年回顧

開blog一年, 我唔係作家, 唔係會計師, 唔係核數師, 唔係經紀, 亦唔係投資專家。

全年共發592 篇文, 平均每日1.6 篇。

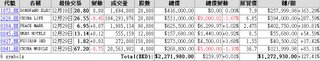

全年投資回報大約130%, 僅僅跑羸年頭的模擬組合, 只怪太早沽出中國人壽呢隻令人如痴如醉的股王。

証明只要年頭做足功課, 小心選股, 不需短炒亦能取得理想回報!

最大回報5隻股票:

東方電機(1072)

偉易達(303)

宜進利(304)

招商銀行(3968)

中信國金(183)

人人皆賺的時候, 30% 只算合格, 50-100% 算合理, 100-200% 算中上, 200% 以上才可算是極佳。

07 我只係睇到大約30-50% 的空間, 情緒太樂觀啦, 要小心選擇離場的時機!

暫時只有3隻心水股作為必然的核心組合成員及作出推介: (預期回報)

湖南有色(2626) (30%)

建滔化工(148) (30%)

雨潤食品(1068) (30%)

當然, 我的核心組仍然包括:

宜進利(304) (N/A)

中石化(386) (20%)

港機工程(44) (30%)

招商銀行(3968) (20%)

偉易達(303) (20%)

VC 風險組合包括:

卓能(131) (150%)

交大科技(300) (80%)

收息組合: (股息回報)

金利來(533) (8%)

偉易達(303) (10%)

3 comments:

your return is very good!

you picked 304 and 303 and concentrated on them in this year....this strategy is proved to be successful!

hi I'm a newbie in stock market...

I would like to know...

the trend of the metals' prices become complicated this year, and 2626 has huge dependency on the metals' prices... Would you mind sharing the reason behind your confidence on 2626?

Thanks a lot.

Some question for you first:

1) "metals' prices become complicated this year"...what metals? related to 2626?

2) Did you search for any materials about 2626 in this blog?

Post a Comment